Francijas tirgus analīze 2021: Santehnikas vidējā cena ir zema, Un aksesuāru cena tiešsaistē pieaug

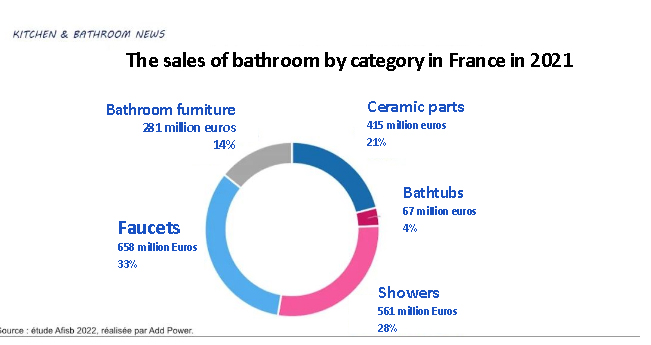

Saskaņā ar Franču vannas istabu asociācija atskaite, iekšā 2021, Francijas vannas istabas nozares pārdošana (ražotāja rūpnīcas pārdošana) sasniedzams 1.983 triljoni eiro, palielināt 15%. Sasniegts pārdošanas pieaugums 17 procents. Katrs no krāniem un veidgabaliem, dušas un vannas, vannas istabas mēbeles un keramika veidoja vienu trešdaļu.

Vidējā cena ir zemāka 2021 salīdzinot ar 2019. Pārdošanas apjoma pieaugums bez cenu pieauguma. Tomēr, dažās kategorijās, pārdošanas pieaugums ir lielāks nekā sanitārās keramikas apjoma pieaugums, vannas, karte un dušas. Jaucējkrānu un dušu tirdzniecība, cita starpā, palielinājies apjoms, bet ne cena. Jaucējkrānu pārdošanas apjomi pieauga par 11% un pārdošanas apjomi pieauga par 15%. Dušas durvis un dušas ekrāni redzēja an 11% pārdošanas apjoma pieaugums un a 12% apjoma pieaugums. Tā vidējā cena samazinās.

Starp viņiem, sasniegts sanitārās keramikas pārdošanas apjoms 415 miljons eiro (izņemot šasiju), ar kopsummu 7.78 miljons gabalu. No šiem, sasniegta tualešu tirdzniecība 4.5 miljons (izņemot ginekoloģiskos mazgātājus). Tas tika pārdots galvenokārt komplektu veidā. Tam ir vertikāla (3.2 miljons) un apturēta (500,000), veido divas trešdaļas no kopējā keramikas gabalu skaita (ieskaitot izlietnes un tvertņu turētājus), bet ir vērts mazāk par pusi. Turpretī, sasniegtais iekavu skaits 925,000 kopas. Bija vērts 123 miljons eiro, vai 12% no kopējā apjoma.

Iekšā 2021, divas trešdaļas no 600,000 pārdotās vannas būs no sveķiem. Citu sintētisko materiālu skaits ir mazāks par 10%, uzskaitot apmēram 20% no kopējās vērtības. Tur bija 9,000 viensistēmas burbuļvannas pārdod 2021, uz leju 2% salīdzinot ar 2019. Vairāk nekā trīs ceturtdaļas franču patērētāju izvēlas izmantot jauktas sistēmas vannas.

Saskaņā ar aptuveniem aprēķiniem, no 1.2 gadā pārdoti miljoni dušas paliktņu 2021 (167 miljonu eiro vērtībā, augšup 16% salīdzinājumā ar gadu iepriekš), pret 550,000 ir keramikas kategorijā, pārējais izgatavots no sintētiskiem materiāliem (ieskaitot sveķus) vai čuguns.

Dušas tirgus veido 18% vannas istabas nozares un galvenokārt ir sadalīta dušas durvīs, dušas kabīnes un dušas aizsegi. Tas ir pārdots 2 miljonu vienību vērtībā 350 miljons eiro, palielināt 23% salīdzinājumā ar gadu iepriekš. Dušas durvis veidoja 61% no kopējās vērtības un 59% no kopējā pārdošanas apjoma. Dušas aizsegi 10% no kopējās vērtības un 17% no kopējā pārdošanas apjoma. Dušas kabīnes veidoja 29% no kopējās vērtības un 24% no kopējā pārdošanas apjoma.

To virza Francijas mājokļu palīdzības programma MaPrimAdapt, tā mērķis ir atjaunot 400,000 mājokļu vienības starp 2019 un 2022. Sasniegta dušu tirdzniecība 90,000 vienības ar kopējo vērtību 44 miljons eiro, augšup 35% salīdzinājumā ar gadu iepriekš. Piederumu, piemēram, jaucējkrānu, pārdošanas apjoms sasniedza 658 miljonus eiro, palielināt 11% salīdzinājumā ar gadu iepriekš. Tiek ņemti vērā hibrīdie jaucējkrāni 26% no kopējās summas un 41% no kopējā apjoma.

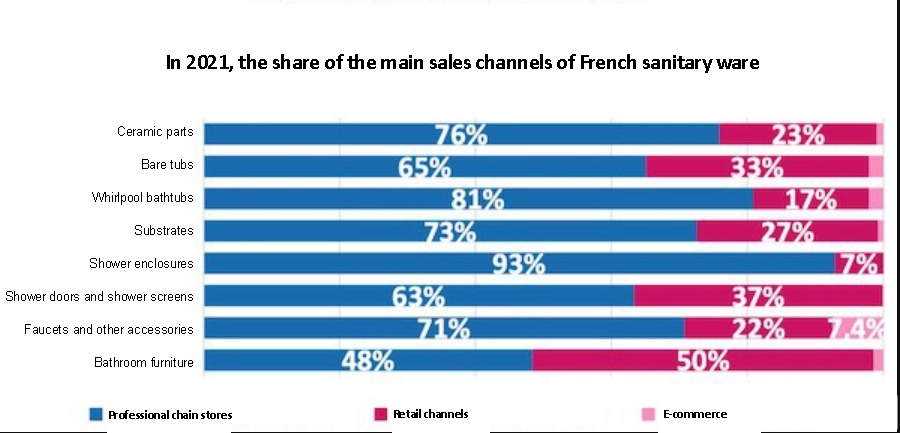

Vannas istabas mēbeļu tirdzniecība sasniegta 281 miljons eiro, augšup 15 procentos no gada iepriekšējā gada vērtībā. Tā pieauguma temps palielinājās par 11 punkti. Starp viņiem, 34% bija plakanas mēbeles (kopas) un 66% tika saliktas mēbeles. Tās galvenais kanāls joprojām ir masveida mazumtirdzniecība, kas veido 50% no kopējās kanāla vērtības. Īpašais kanāls vietās, piemēram, būvmateriālu lielveikalos, piemēram, Leroy Merlin veidoja 7%, vai 1.688 triljoni eiro.

Francijas e-komercijas kanāls strauji aug. Visās kategorijās, jaucējkrānu e-komercijas kanālu 7.4% no tirgus daļas, savukārt dušas telpa pagaidām nav būtiski attīstījusies.