Ranskan markkinoiden analyysi 2021: Terveysvarastojen keskimääräinen hinta on alhainen, Ja lisävarusteiden online -hinta on nousussa

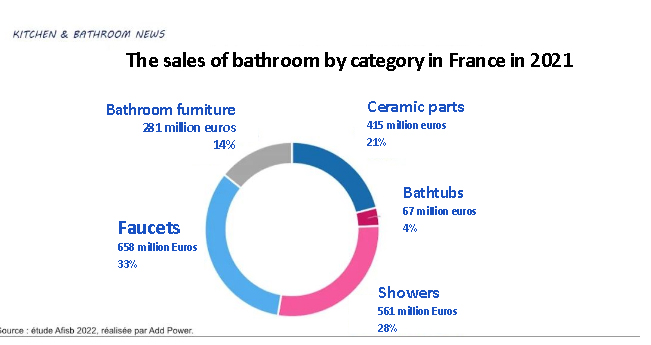

Mukaan French Bathroom Association raportti, sisään 2021, the French bathroom industry sales (manufacturer ex-factory sales) saavutettu 1.983 Miljardi euroa, kuin 15%. Sales growth reached 17 prosentti. Each of taps and fittings, showers and bathtubs, bathroom furniture and ceramics accounted for one-third.

The average price is lower in 2021 verrattuna 2019. Sales increase in volume without price increase. kuitenkin, in some categories, sales growth is greater than volume growth for sanitary ceramics, kylpyammeet, sump and showers. Sales of faucets and showers, muun muassa, increased in volume but not price. Sales of faucets increased by 11% and sales increased by 15%. Shower doors and shower screens saw an 11% increase in sales and a 12% increase in volume. Its average price is going down.

Heidän joukossaan, sales of sanitary ceramics reached 415 miljoonaa euroa (excluding chassis), yhteensä 7.78 miljoona kappaletta. Näistä, sales of toilets reached 4.5 miljoonaa (excluding gynecological washers). This was sold mainly in the form of sets. It has vertical (3.2 miljoonaa) and suspended (500,000), accounting for two-thirds of the total number of ceramic pieces (including sinks and tank holders), while being worth less than half. Sitä vastoin, the number of brackets reached 925,000 sarjat. It was worth 123 miljoonaa euroa, tai 12% kokonaismäärästä.

sisään 2021, two-thirds of the 600,000 bathtubs sold will be made of resin. The number of other synthetic materials is less than 10%, noin 20% of the total value. There were 9,000 single-system whirlpool tubs sold in 2021, alas 2% verrattuna 2019. More than three-quarters of French consumers prefer to use mixed system bathtubs.

Karkeiden arvioiden mukaan, niistä 1.2 million shower trays sold in 2021 (worth €167 million, ylöspäin 16% vuosi vuotta aiemmin), noin 550,000 are in the ceramic category, with the rest made of synthetic materials (including resin) or cast iron.

The shower market accounts for 18% of the bathroom industry and is mainly divided into shower doors, shower enclosures and shower screens. It has sold 2 million units worth 350 miljoonaa euroa, kuin 23% vuosi vuotta aiemmin. Shower doors accounted for 61% of the total value and 59% of the total sales volume. Shower screens accounted for 10% of the total value and 17% kokonaismyynnistä. Shower enclosures accounted for 29% of the total value and 24% of the total sales volume.

Driven by the French housing assistance program MaPrimAdapt, it aims to renovate 400,000 housing units between 2019 ja 2022. Sales of showers reached 90,000 units with a total value of 44 miljoonaa euroa, ylöspäin 35% vuosi vuotta aiemmin. Sales of accessories such as faucets reached €658 million, kuin 11% vuosi vuotta aiemmin. Hybrid faucets accounted for 26% of the total amount and 41% kokonaismäärästä.

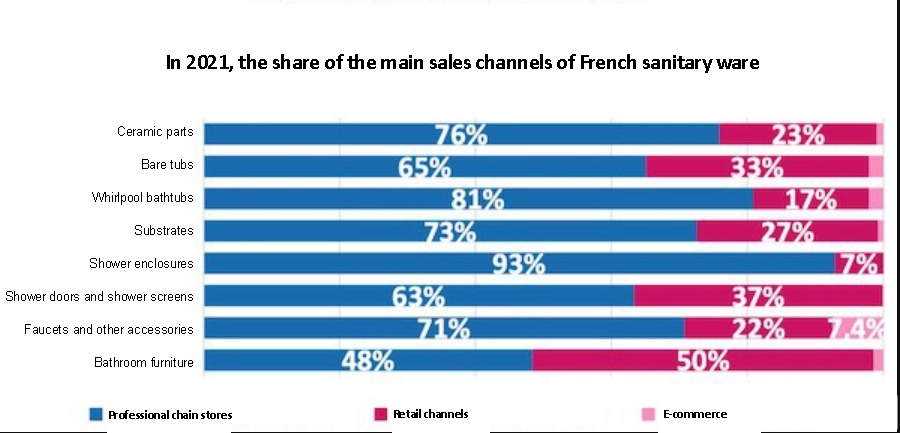

Sales of bathroom furniture reached 281 miljoonaa euroa, ylöspäin 15 prosenttia edellisvuodesta. Its growth rate increased by 11 piste. Heidän joukossaan, 34% were flat-pack furniture (sarjat) ja 66% were assembled furniture. Its main channel is still mass retail, which accounts for 50% of the total channel value. The specialty channel in places such as building materials superstores such as Leroy Merlin accounted for 7%, tai 1.688 Miljardi euroa.

The French e-commerce channel is growing rapidly. In all categories, the e-commerce channel of faucets accounted for 7.4% markkinaosuudesta, while the shower room has not developed significantly for the time being.

VIGA-hanan valmistaja

VIGA-hanan valmistaja